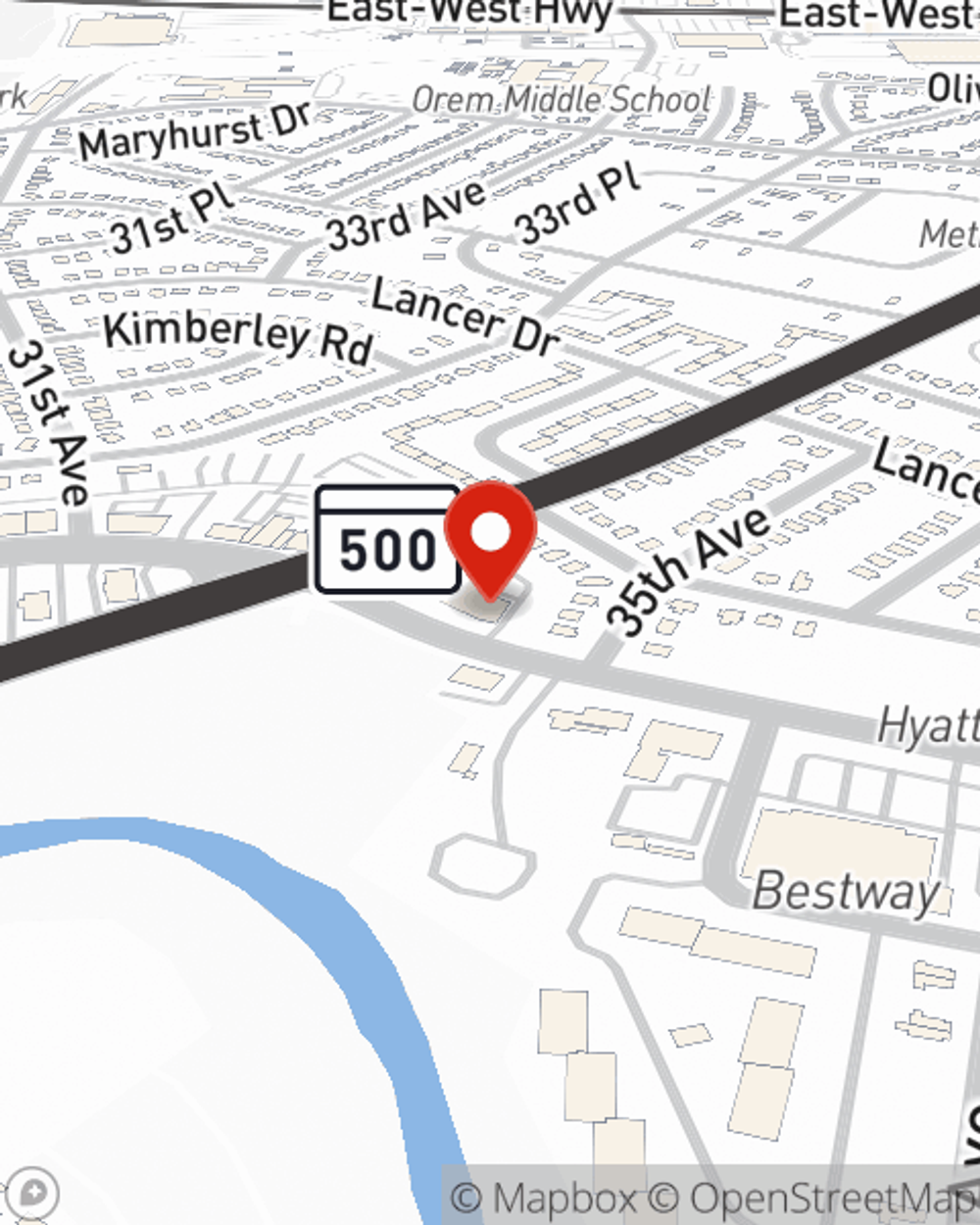

Renters Insurance in and around Hyattsville

Looking for renters insurance in Hyattsville?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through providers and coverage options on top of managing your side business, work and your pickleball league, can be overwhelming. But your belongings in your rented townhome may need the terrific coverage that State Farm provides. So when trouble knocks on your door, your home gadgets, pictures and furnishings have protection.

Looking for renters insurance in Hyattsville?

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

Renters insurance may seem like last on your list of priorities, and you're wondering if it can actually help you. But take a moment to think about how difficult it would be to replace all the belongings in your rented property. State Farm's Renters insurance can help when unexpected mishaps damage your valuables.

If you're looking for a dependable provider that can help you understand your options, reach out to State Farm agent Paul Dougherty today.

Have More Questions About Renters Insurance?

Call Paul at (301) 927-1391 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Paul Dougherty

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.